Life

insurance

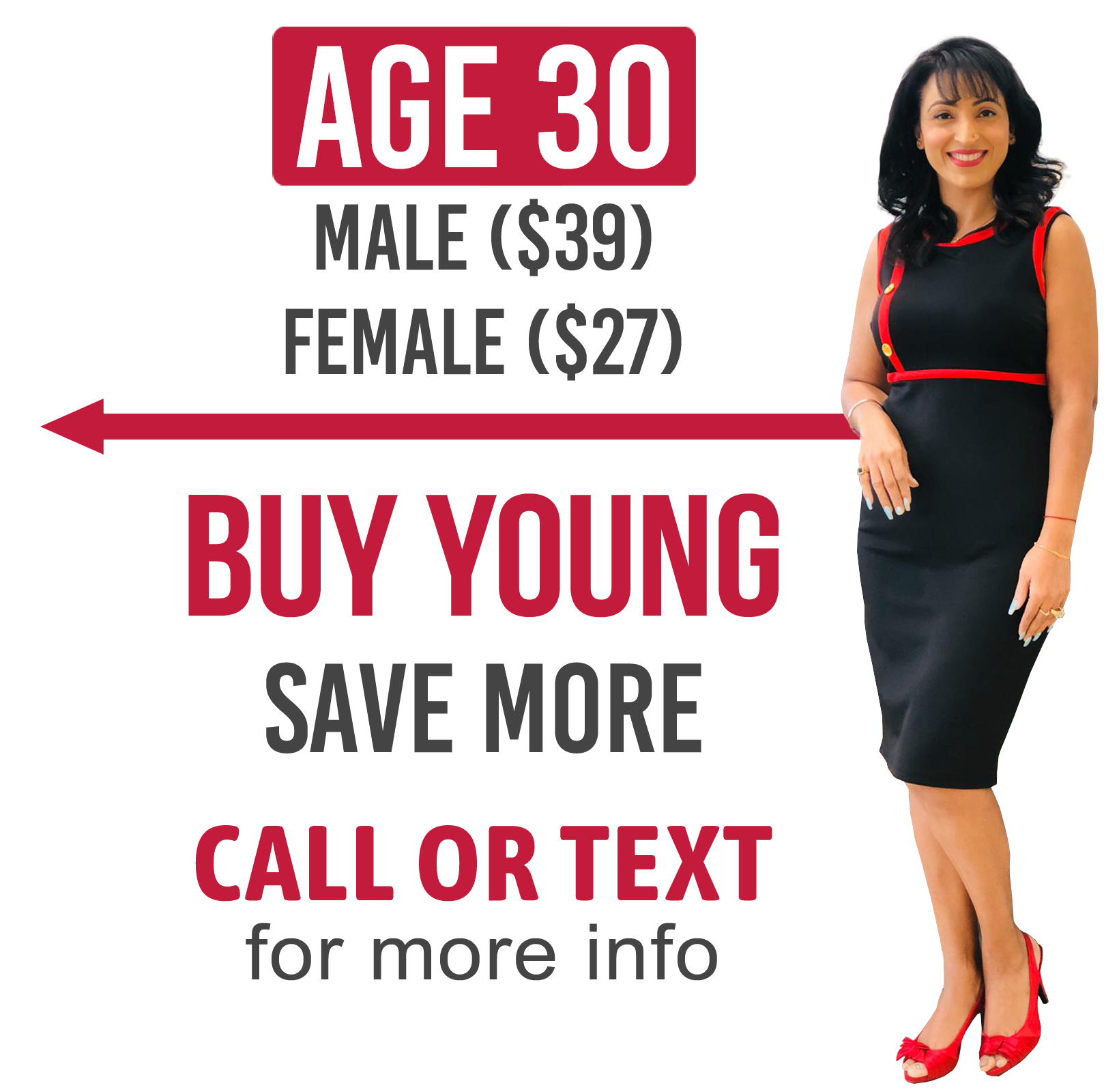

Life Insurance is called Love Insurance Buy Young Save More

TERM INSURANCE

TERM INSURANCE

Affordable Coverage when you need it!

The best tool to transfer all your Financial Risk to the Insurance Companies. Knitting the Financial Safety net for yourself and your loved ones!

- Short Term Coverage

- Customisable Term & Protection

- Monthly / Annual Premiums

- Lower Insurance Premiums

- Higher Face out or Death Benefit

- Payouts are Tax Free

LIFE INSURANCE

Life Insurance

Covers it all

Safeguarding your family’s future is a must, particularly if you are the only or primary breadwinner in the household. Life insurance is what keeps your family safe and sound even when you are not around.

Having an Expert Insurance Advisor is desirable to go through the Insurance Buying process efficiently. Each Life Insurance Policy is different in terms of assets, income, life goals, and financial liabilities. Therefore always purchase life insurance with the guidance of an Expert Insurance Advice.

INSTANT Life Insurance Quote

GET LIFE INSURANCE QUOTES IN A FEW SECONDS

MILLION DOLLAR INSURANCE

Million Dollar Life Insurance

If the unthinkable happened and your family faced a future without you, a life insurance policy is your family’s financial safety net. A good rule of thumb is to have coverage that’s about 5 to 10 times your annual salary. So if you earn $100,000 a year, a $1 million life insurance policy may be the right choice for you.

BENEFITS OF life INSURANCE

Financial Security

Money from a Life Insurance can act as a cover and makes sure that your family’s life goals are not affected under any circumstance.

Prevent Mortgage Burden

Mortgages can be repaid without the risk of your family losing an asset or stressing about arranging funds in case something happens to you.

Tax Benefits

You can save annual tax as the premiums and pay-offs paid towards your Life Insurance under Canadian Law are non-taxable.

Secure Your Child's Future

Life Insurance can give your child the best education possible and their dreams even when you are not around anymore.

Buy Young, Save More

Life insurance plans give you the ability to lock in low premium rates while you’re young. The early you buy, the cheaper you get.

Leave Behind a Legacy

If you really love your family and care about their finances then you should buy Life Insurance and leave behind a legacy, not gofundme.

Life Insurance is not necessary but is a smart investment to make, especially if you have a dependent spouse and children. It offers your family the benefit of financial support even after your death. In addition to this, it offers a number of advantages and provides a lot of flexibility on your investment.

The amount that you receive on maturity depends on the amount of premium you pay. The maturity benefit you need depends on your standard of living, income, spending habits, etc. You should aim to receive a maturity amount equal to 8 to 10 times your annual salary.

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Financial stability for your loved ones even after you are not there. There’s alsoRegular Money back payouts in case you have opted for a money back plan. Further you get tax benefits in case you have Life Insurance coverage.

If you are earning member of the family you should buy a life insurance to ensure that your family continues to receive income even when you are not there. A life insurance policy is like a financial safety net that protects your family financially in your absence.

HAPPY TO HELP!

Get Free Quote

Let me know if there’s anything else I can do for you. I’m happy to help - Sherjang Singh Rana mDRT.

Get Life Insurance Free Quotes with Sherjang Singh Rana to secure your family against the odds of life in a few clicks.